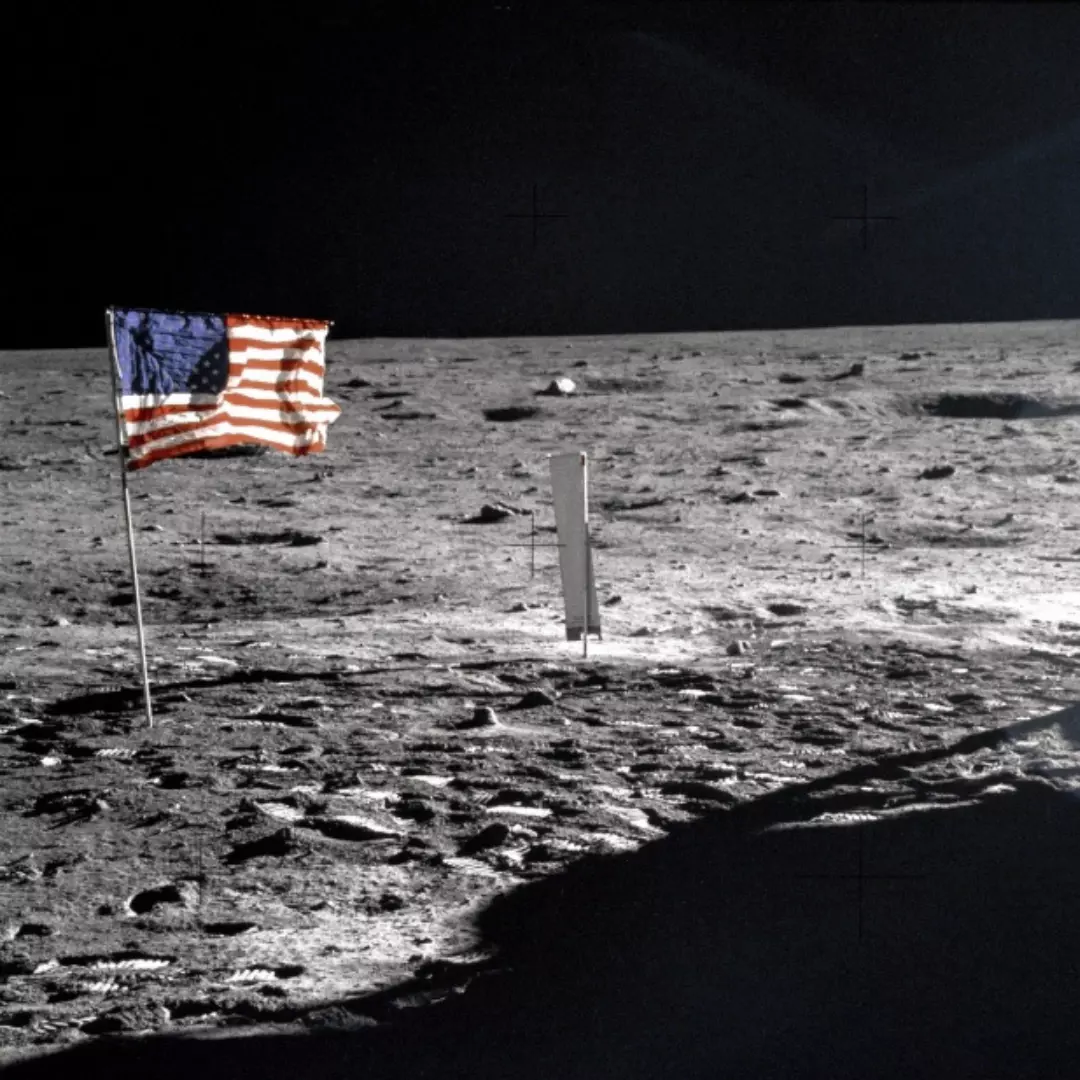

The third part in our tour of equity based compensation. If RSUs are beer and Options are whisky that would make Founders Equity (or direct equity) moonshine.

Note that this page will be using the following terms:

Terms

- 83b Election - Form you can send to the IRS to prepay taxes at the current stock value.

- Cliff - a period that an employee must work before any of their equity or stock options vest.

- Dispose - To sell

- Long Term Capital Gains - If you hold on to an equity for over a year you are taxed as long term capital gains and taxed at a flat 15%.

- Priced Round - A fund raising round where founder and investor agree on a "price" that a share is worth.

- Proceeds - How much you got when you sold the equity.

- Spread - The difference between how much you sold something for vs. how much you bought it for. (i.e: Proceeds - CostBasis).

- Long Term Capital Gains - If you hold on to an equity for less than a you are taxed as short term capital gains and taxed at your income tax rate.

- Strike Price - The price per share of the underlying in an option

- Vest - vesting is a process used by companies to grant ownership stakes or stock options to employees or partners over a set period of time.

What is Founders Equity?

Founders equity (also known as "direct equity") allows for direct ownership of the shares of a company. Importantly this includes voting rights.

Oftentimes vesting and cliffs will apply just like with other forms of equity compensation. When founders equity on vest will translate to direct ownership of the underlying company.

83(b) Elections

83(b) elections is an option to prepay taxes on an equity compensation package. In the case of founders equity this is done at the time of issuance, no need to wait on any cliffs or vests.

This is especially important for founders equity as the initial value of the stock will be quite low so prepayment of taxes on that equity will also be very low.

The Rise of SAFEs

Recently for early stage companies it's become popular to use SAFEs, short for "Simple Agreement for Future Equity". Developed by Y Combinator, it was an effort to avoid pricing a company because early stage companies don't really have much data from which you could derive a share price from.

In a SAFE Investors give money to a startup under a SAFE in exchange for rights to future equity in the company, typically in connection with a specific event, usually the next round of financing.

In exchange for cash now investors have the option to purchase some equity at a later date at some per-determined discount (usually 8-10%).

Importantly; SAFEs allow founders to raise money without having to agree to a share price.

❤️ SAFEs and 83(b) Elections are BFFs ❤️

One thing that makes founders equity so powerful is the combination of SAFEs and 83(b) elections.

The founding documents of a company will initially set the share price of a company (known as par value).

Typically companies are started with 10 Million shares at a par value of $0.00001 per share. Making the total "book value" of a company worth $100.

A par value of $0.00001 per share stays the price of a company until there is some event that gives it a different price. This typically happens during a fundraising round when the founder and investor agree on a valuation of the company. SAFEs do not put a valuation on a company and provide a mechanism that allows founders to raise funds while keeping the share price at $0.00001.

Founders or early employees that join will often choose to prepay their taxes on the equity they are issued since the total value of the grant is extremely low. If those shares one day do become profitable then the first 10 million in profit are essentially tax free.